INTRODUCTION OF THE CO2 EMISSION CLASS INTO THE COST OF TOLLS IN EUROPE

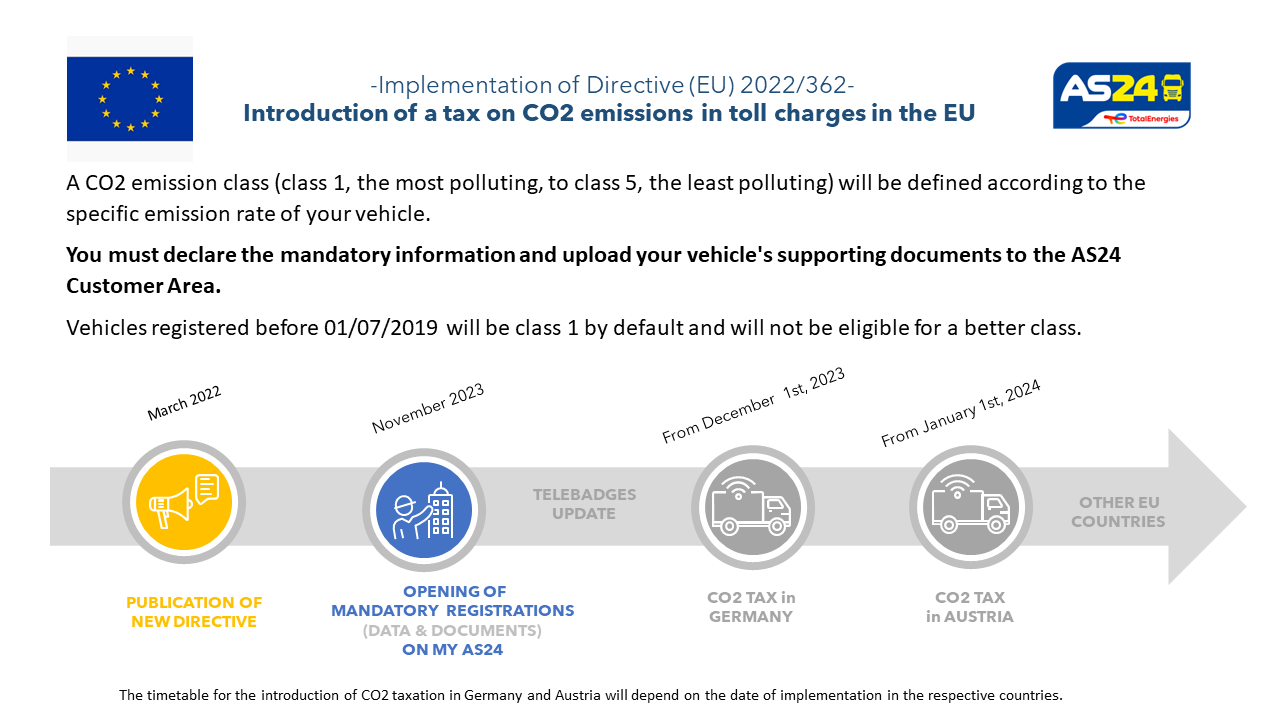

In order to accelerate the decarbonisation of the land transport sector, Directive (EU) 2022/362 of the European Parliament now requires Member States to introduce a CO2 emissions tax into the taxation of vehicles for the use of certain infrastructures.

This obligation will apply to all EU Member States according to the timetable set out in their national legislation. Germany and Austria are the first two countries to have planned the application of this Directive on their territory; from 01/12/2023 and 01/01/2024 respectively.

How will this directive be applied?

- A CO2 emission class will be defined according to the vehicle's specific emission rate and other criteria.

Each vehicle will be classified from 1 to 5 according to its level of CO2 emissions. Class 1 corresponds to the most polluting vehicles and class 5 to the least polluting vehicles.

- Vehicles registered before 01/07/2019 will automatically be in class 1.

Your obligations:

All customers must update the information used to to define the CO2 emission class of their vehicles:

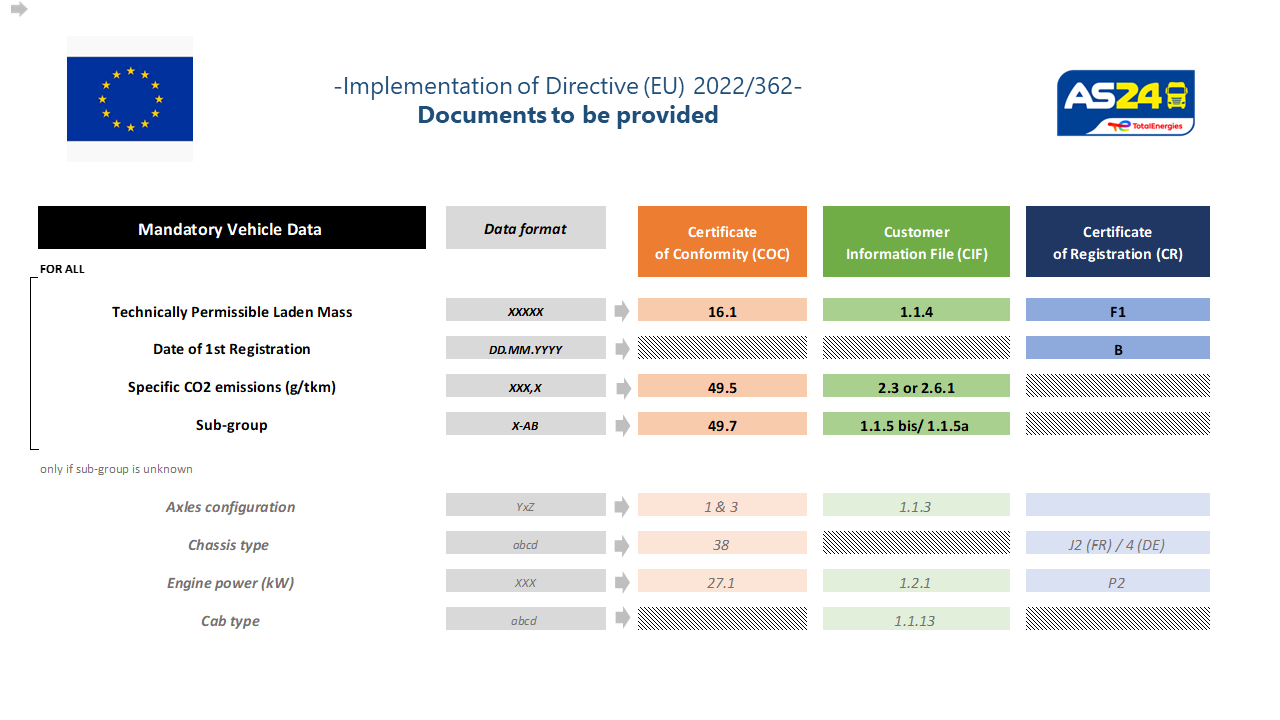

- Date of 1st registration

- Sub-Group and/or Group

- Specific emission rate

Documents proving this information (COC, CIF, registration certificate) will be mandatory.

Remarks :

If no declaration is made by the deadline, vehicles will automatically be classified in class 1. It will be possible to claim a better class by declaring the information after the deadline.

The F1 weight shown on the registration certificate will be used as compulsory data for calculating the road infrastructure use tax.

AS 24 obligations:

- Declare your calculated CO2 emission class to the authorities

- Personalise your PASSango telebadge with the calculated Class

-

From November 2023, you will be able to update the mandatory data for your vehicles from your Customer Area and upload the supporting documents.